Battle Royale: The Federal Reserve vs. Inflation

Two months into 2023, the Federal Reserve is still fighting inflation in the battle royale that began in early 2022. At various points throughout the battle, each combatant has appeared to gain the upper hand. Throughout the conflict, the stock market has acted as a barometer for the struggle: as inflation appeared to weaken, stocks rallied, and vice versa.

In 2022, the Fed’s attack strategy of raising rates proved to be working well as consumer price inflation eased for three consecutive months. From the market’s low in October to its recent high in early February, the S&P 500 rallied 17%. But new data showing an upturn in inflation and a stronger-than-expected economy have demonstrated that victory is not quite yet at hand.

Source: Kestra Investment Management, U.S. Bureau of Labor Statistics with data from Federal Reserve Bank of St. Louis. Data as of February 28, 2023.

Will Inflation Ever Subside?

While inflation is typically discussed and used as a “catch-all” term for prices, it’s actually comprised of the movements of multiple types of prices throughout the economy. We can break these sections into three broad categories: goods, shelter, and wages. Right now, each category occupies a different stage of the fight against inflation, some better and others worse off.

Goods

Goods prices include a wide variety of tangible items for purchase, including products such as cars, eggs, and gasoline. These types of prices tend to move more dramatically and more quickly than other types of prices. Recently, with help from lower commodity prices, consumer durable goods prices – a subset of consumer goods – are actually lower than they were a year ago, and leading indicators suggest further easing. Supply chains have come unsnarled, pushing the rate to ship a container overseas to pre-covid levels, helping to drive down the end costs of many consumer goods. Meanwhile, various surveys suggest that medium and long-term inflation expectations are back to normal ranges.

Shelter

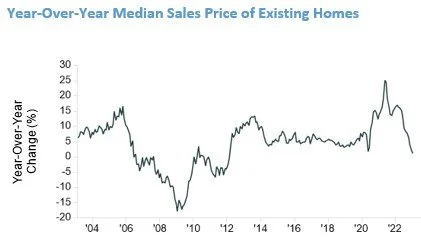

Shelter prices consist of two major components – home prices and rent – which tend to move much more slowly than goods prices. That said, we are seeing signs of easing. As of January, existing U.S. home sales have decreased for twelve consecutive months. That dramatically slower buying activity takes time to filter through to broad measures of housing prices, yet that too is beginning to happen. In January, the median sales price of existing homes increased by just 1.3% to $359,000, the smallest annual gain since February 2012.

Source: Kestra Investment Management, U.S. National Association of Realtors with data from FactSet. Data as of February 28, 2023.

Wages

With both goods and shelter prices easing, what’s all the fuss about inflation? The short answer is wages, which tend to move more slowly and, as such, once elevated, are much more difficult for the Fed to combat. Annual wage growth in the private sector remains high at 6.1% as of January, after peaking last August at 6.7%. Helping drive those wage gains, jobs remain plentiful as employers added an astonishing 517,000 jobs last month. Despite employers increasing wages to try and keep pace with inflation to retain talent, it is estimated that 66% of Millennials and 72% of Gen Z workers are planning to switch jobs in 2023, suggesting that it will be difficult for employers to hold the line on further wage increases.

What Does All This Mean for Investors?

With the Fed and inflation still fighting in the trenches of this prolonged battle over prices, investors should continue to expect more turbulence ahead in 2023. Based on the latest data showing a stronger economy and still-rapid price increases, the Fed will likely raise rates multiple times over the next few months to further slow economic growth. While the prospects of a hard, soft, or no landing remain hotly debated, investors with well-diversified portfolios that stay the course despite market gyrations should be positioned for solid long-term growth.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Advisor Services Holdings C, Inc., d/b/a Kestra Holdings, and its subsidiaries, including, but not limited to, Kestra Advisory Services, LLC, Kestra Investment Services, LLC, Bluespring Wealth Partners, LLC, and Grove Point Financial, LLC. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by any entity for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was created to provide accurate and reliable information on the subjects covered but should not be regarded as a complete analysis of these subjects. It is not intended to provide specific legal, tax or other professional advice. The services of an appropriate professional should be sought regarding your individual situation. Kestra Advisor Services Holdings C, Inc., d/b/a Kestra Holdings, and its subsidiaries, including, but not limited to, Kestra Advisory Services, LLC, Kestra Investment Services, LLC, Bluespring Wealth Partners, LLC, and Grove Point Financial, LLC. Does not offer tax or legal advice.