The Impact of Rising Interest Rates

Over a year and a half ago, the Federal Reserve began raising the fed funds rate in an effort to slow inflation, which had reached rates not seen in decades. Since then, inflation has subsided substantially, yet interest rates have continued rising. And with interest rates marching higher, bond prices have fallen to the detriment of bond investors. What’s driving those rate increases, and what are implications for consumers, businesses and investors?

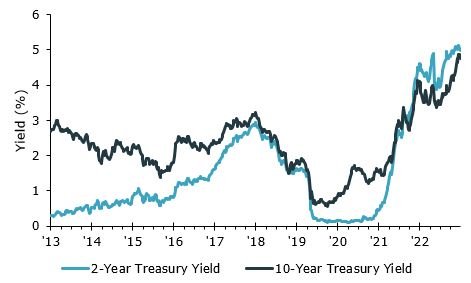

United States 2-Year and 10-Year Historical Yields (%)

Source: Federal Reserve Bank of St. Louis. Data as of November 03, 2023.

What is driving higher interest rates?

As powerful as the Fed may be, it’s important to remember that those officials only directly control the fed funds rate, or the interest rate charged to banks overnight. The Fed uses rate hikes to slow the economy to reach its 2% inflation target (though some economists believe that target is unrealistic). Other, longer-term interest rates, such as those that affect mortgages, are determined by market forces, such as inflation, how fast the economy is growing and investor demand for bonds.

Lately, economic growth has been remarkably resilient, signaled by solid employment, a pick-up in manufacturing and rising business spending on durable goods. With that stronger growth, long- and short-term interest rates have been rising.

Another important driver of interest rates is inflation, or more specifically what market participants think inflation will be in the future. Over the last year or so, even as the Fed has raised rates, consumers have become much more sanguine about inflation. When asked, consumers report that they expect inflation to be under 4% next year, down from their expectations of nearly 7% in 2022. Normally, those lower inflation expectations would signal lower rates.

But other measures reveal a more-sticky inflation picture. For instance, the more technical and longer-term indicator called the 5-year-5-year forward inflation expectation rate, has been stealthily rising, suggesting that investors believe inflation ten years from now will be higher than over the last ten years. This expectation could be helping to push up long-term bond yields.

Another driver of higher rates is likely the $2 trillion-and-growing budget deficit. As the government spends more, it needs to issue more debt to pay for that spending. That means more bonds available in the market. Yet this comes at a time when we have fewer bond buyers. China, typically a major purchaser, is immersed in its own investment and real estate challenges and has tempered its purchases of US government bonds. With fewer natural buyers of its bonds, the US government must make its offerings more attractive by offering investors higher yields.

What are the implications of higher rates?

For bond investors, rising rates drive down bond prices and eat away at portfolio values. Investors in long-term Treasuries, in particular, have been hard hit during the recent runup in rates. One ETF that tracks the value of the 20-year Treasury bond has lost 50% of its value since 2020. The more broadly diversified Bloomberg Aggregate bond index has fallen over 20% in that same time period.

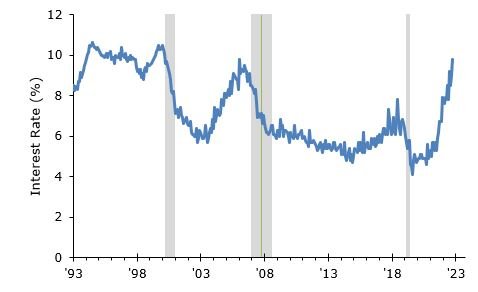

High interest rates also have obvious drawbacks for the broad economy. Rising mortgage, auto financing, and credit card rates drive up costs for consumers. Higher borrowing costs are also a headwind for corporate earnings. Small businesses have seen sharp increases in the interest rates they are paying on short-term loans.

NFIB: Actual Interest Rate Paid on Short-Term Loans by Borrowers (%)

Source: FactSet and Federal Reserve Bank of St. Louis. Data as of October 31, 2023.

But higher rates are not all bad. With higher yields, investors are being compensated for holding fixed income at a level not seen in decades. That means that future returns are likely to be much more attractive than the last few years. Fidelity reports that Millennials, who once eschewed bonds for stocks, now have up to 45% of their portfolio in bonds and other fixed income assets.

In addition, savers are now being rewarded handsomely for hanging on to their piles of hard-earned cash. Low risk money market funds and bank CDs are offering rates not seen since before the global financial crisis.

The path forward

While certain areas of the bond market have been hard hit because of rising interest rates, investors with diversified portfolios have seen much less volatility. With bonds of varying maturities and different issuers, plus some help from the stock market, balanced portfolios have enjoyed more attractive returns. While we expect that much of the pain from rising interest rates is behind us, the key to navigating volatility remains diversification.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Advisor Services Holdings C, Inc., d/b/a Kestra Holdings, and its subsidiaries, including, but not limited to, Kestra Advisory Services, LLC, Kestra Investment Services, LLC, and Bluespring Wealth Partners, LLC. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by any entity for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was created to provide accurate and reliable information on the subjects covered but should not be regarded as a complete analysis of these subjects. It is not intended to provide specific legal, tax or other professional advice. The services of an appropriate professional should be sought regarding your individual situation. Kestra Advisor Services Holdings C, Inc., d/b/a Kestra Holdings, and its subsidiaries, including, but not limited to, Kestra Advisory Services, LLC, Kestra Investment Services, LLC, and Bluespring Wealth Partners, LLC. Does not offer tax or legal advice.