Will Student Loan Re-Payments Weigh Down the Economy?

Back in 2020, as part of the government’s aggressive efforts to combat the pandemic-stricken economy, the Department of Education paused payments on federal student loans, providing relief to tens of millions of individuals. After a Supreme Court case thwarted the president’s efforts to completely forgive those loans, those individuals must now resume repayments. Investors have understandably asked, how will this affect the economy and the market?

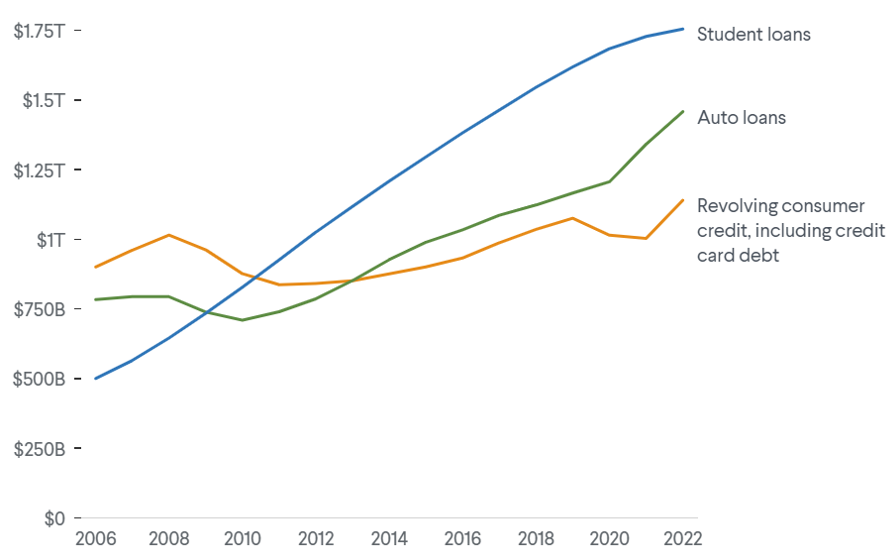

The sizealone of the student loan market warrants attention. Approximately $1.7 trillion in student debt represents nearly 10% of consumer spending, and exceeds credit card and auto loan indebtedness. And the debt growth is staggering: Borrowers’ balances ballooned by 25% from 2009-2021. Of the 43-46 million holders, more than half (27.4 million) are in forbearance.

With so many Americans paying off student loans, the Covid-era forbearance program provided welcome relief to many pocketbooks and helped fund additional spending and borrowing. As households resume making $70 billion in annual (previously paused) loan payments, we could see some of those impacts reverse.

For instance, consumer spending could feel the pinch. Every 1% increase in debt translates to a 3.7% decline in consumption. It’s easy to see why. Monthly payments averaging $393, or $217 billion annually, equate to 1.1% of disposable income. That means fewer dollars allocated to savings, which at 4.3%, is the lowest rate since 2008. Millennials, who hold a disproportionate amount of the debt, may see their spending hampered by 65-85 basis points.

U.S. Consumers: 25 to 34 Year Olds Changes in the Cost of Necessities

Source: Federal Reserve Board, U.S. Department of Commerce, Investment Company Institute, The Vanguard Group, Census Bureau, and Empirical Partners Analysis. Data as of September 30, 2023.

Pinched pocketbooks can have wider ramifications as well. The already-struggling housing market, for instance, may suffer: 36% of student debtholders are less likely to purchase a house. Even analysts are concerned, with company earnings calls seeing a growing number of references to student loan repayments in Q2.

Student Loans Cause Groans

Source: Goldman Sachs GIR and Goldman Asset Management. Data as of September 10, 2023.

Despite these potential drags, we see a plausible case for limited negative impact. High-earning households comprise the bulk of outstanding debt (40% of households are in the top quintile) and are better positioned to make payments. They also tend to hold the bulk of the $600 billion in excess savings, which can help offset the expense, and tend to have higher earning power.

In addition, student loan debt as a percentage of GDP has declined for the past two years, from 8.3% in 2020 to 6.7% in 2022, a signal that greater output can combat the debt drag. And believe it or not, the inflation rate of college tuition has been declining for a couple of decades.

Finally, although the Supreme Court ruled against wiping out student loan debt, the Biden Administration is proposing two workarounds to help lessen the strain on household budgets: Income-driven repayment (IDRs) and SAVE plans promise some relief.

U.S. Student Loan Debt Has Grown Tremendously

Source: Council on Foreign Relations with data from Federal Reserve Bank of St. Louis. Data as of August 22, 2023.

While repayments may provide a minor headwind to overall economic growth and consumer spending, the student loan picture is just one piece of a very complicated puzzle. Consumer pocketbooks will certainly continue to get pinched by not just repayments, but also soaring interest rates on credit cards and auto loans. But it's also helpful to remember that these payments are simply a resumption of what borrowers were paying before the pandemic.

We’ll continue to keep a close eye on both retail sales and delinquency rates on all types of consumer debt. And as we often like to preach, the best defense against uncertainty is a diversified portfolio and a long-term outlook.

The opinions expressed in this commentary are those of the author and may not necessarily reflect those held by Kestra Advisor Services Holdings C, Inc., d/b/a Kestra Holdings, and its subsidiaries, including, but not limited to, Kestra Advisory Services, LLC, Kestra Investment Services, LLC, and Bluespring Wealth Partners, LLC. The material is for informational purposes only. It represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. It is not guaranteed by any entity for accuracy, does not purport to be complete and is not intended to be used as a primary basis for investment decisions. It should also not be construed as advice meeting the particular investment needs of any investor. Neither the information presented nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. This material was created to provide accurate and reliable information on the subjects covered but should not be regarded as a complete analysis of these subjects. It is not intended to provide specific legal, tax or other professional advice. The services of an appropriate professional should be sought regarding your individual situation. Kestra Advisor Services Holdings C, Inc., d/b/a Kestra Holdings, and its subsidiaries, including, but not limited to, Kestra Advisory Services, LLC, Kestra Investment Services, LLC, and Bluespring Wealth Partners, LLC. Does not offer tax or legal advice.