Our Three Pillar Risk Management Process

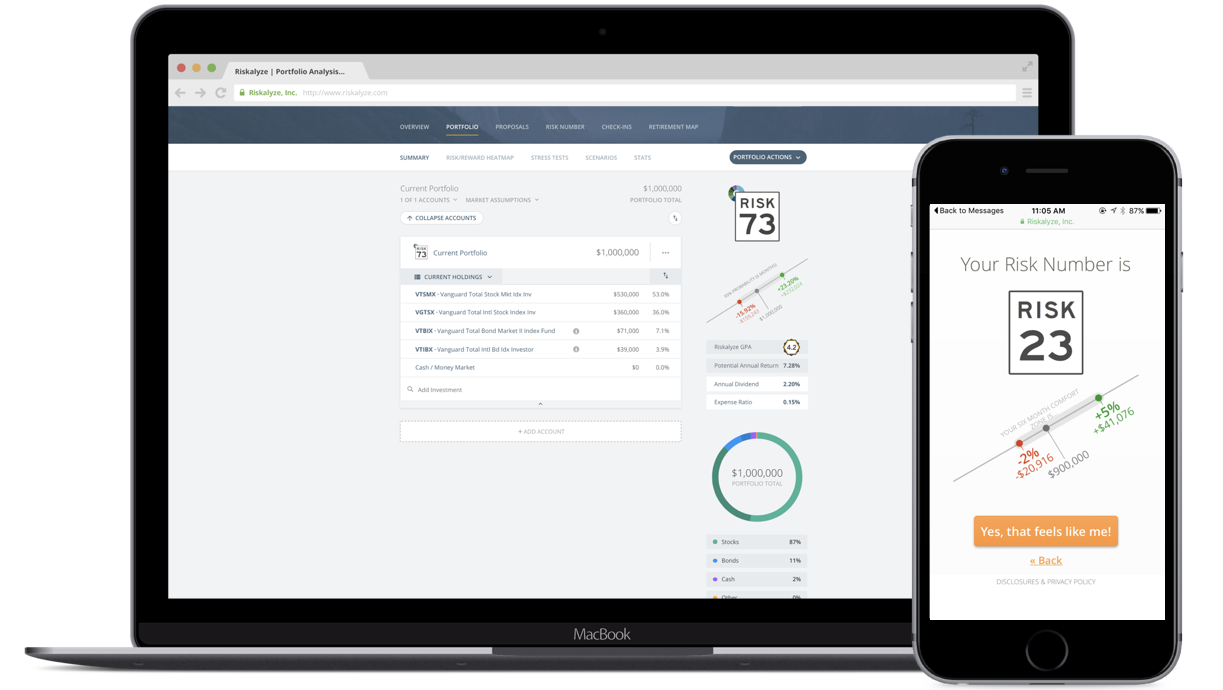

We utilize award-winning technology to quantify investment risk and help drive better financial outcomes for our clients. Ashwood Financial Partners implemented Riskalyze, a risk alignment platform that identifies how much risk investors desire, how much risk they currently have in their portfolio, and how much risk they should take to reach their financial goals.

What is your personal Risk Score?

Click on the button below for a free, no obligation risk analysis.

Pillar I – Define Your Risk Number

Built on a Nobel Prize-winning framework, Riskalyze quantifies a specific Risk Number between 1 and 99 and pinpoints a client’s exact comfort zone for downside risk and potential upside gain with a 95% Probability Range.

Pillar II – Align Your Portfolio

Our team evaluates these factors to build an optimized portfolio that fits our client’s risk tolerance and goals. We stress test the new portfolio against specific market conditions, discuss a 95% probability range, and set expectations for the future.

Pillar III – Define Your Retirement Goals

We chart a path to retirement using a simple, intuitive approach to help our clients visualize the probability of a successful retirement and can adjust dynamically as market conditions and unique circumstances change.

Riskalyze was twice named one of the world’s ten most innovative companies in finance by Fast Company Magazine and has appeared twice on the Forbes FinTech50 list.